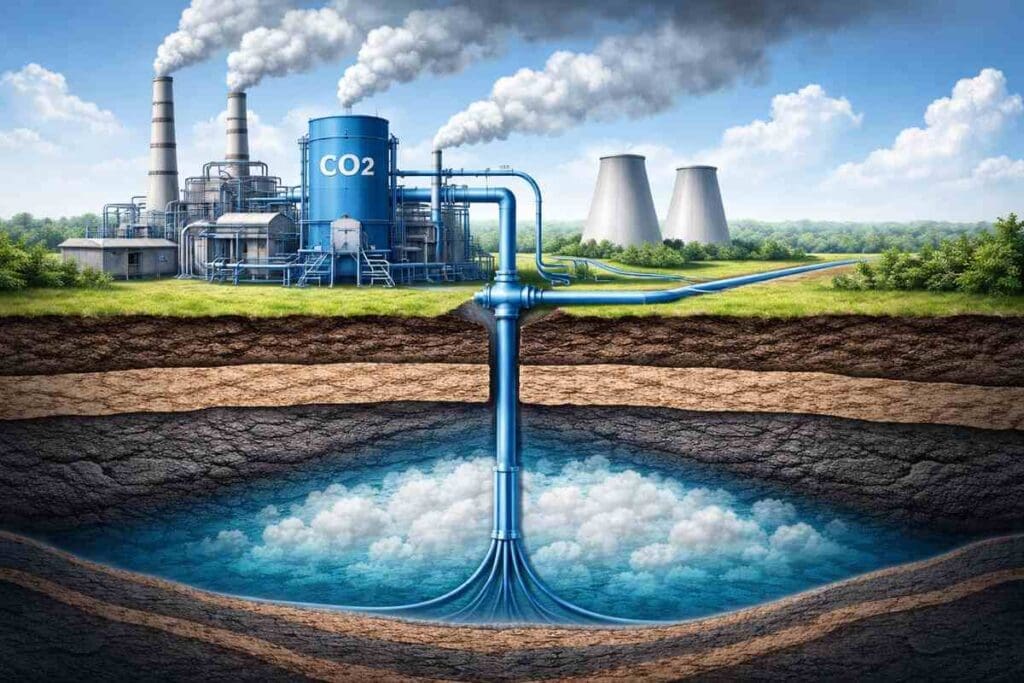

Canada is gearing up to introduce legislation this month aimed at kickstarting subsidies for projects focused on carbon capture and net-zero energy, according to a report by Reuters. This initiative is part of a larger plan estimated at around $20 billion spanning five years.

An extended delay in governmental support for carbon capture utilization and storage (CCUS) initiatives, as well as for infrastructure promoting low-carbon energy production, raised concerns within industry circles. Back in September, industry groups warned of potential jeopardy to roughly C$50 billion ($36 billion) worth of investments unless swift action was taken.

The forthcoming Fall Economic Statement (FES) presentation by Finance Minister Chrystia Freeland to parliament will reportedly unveil the investment tax credit (ITC) funding. This measure, anticipated to be around C$27 billion ($19.7 billion) for the initial five years of operation, is set to be part of the FES legislation to be submitted to parliament later this month.

Accompanying the ITC programs, labour provisions are expected to be introduced to parliament concurrently. These provisions will necessitate adhering to prevailing union wages and offer apprenticeship opportunities to receive maximum subsidies.

In comparison to the U.S., Canada has been lagging in providing similar incentives deemed crucial to stimulate investments in emerging, low-carbon technologies. Washington’s enactment of the U.S. Inflation Reduction Act (IRA) over a year ago has seen significant incentives directed at cleantech companies, totaling $430 billion and resulting in over $132 billion in investment across more than 270 new clean energy projects.

Recognized as pivotal in curbing emissions from Alberta’s oil sands without compromising production levels, CCUS initiatives are gaining traction. Canada, positioned as the world’s fourth-largest oil producer, is emphasizing the transition to a low-carbon economy, a cornerstone of Prime Minister Justin Trudeau’s economic agenda. ITCs serve as a pivotal tool in aiding the government’s aspiration of achieving net-zero emissions by 2050.

An insider familiar with the situation highlighted, “There’s a global competition for capital and investments in these projects. The government aims to offer certainty to potential investors.”

The finance ministry refrained from commenting on fiscal documents before their official publication, according to a spokesperson.

Get the Green Building Project Checklist

Use this handy checklist on your next project to keep track of all the ways you can make your home more energy-efficient and sustainable.

While the CCUS and cleantech ITCs were announced in spring 2021 and a year later, respectively — predating the U.S. IRA launch — Canada is presently initiating the legislation necessary to mobilize these funds.

Freeland is anticipated to outline timelines for the remaining promised ITCs, with public consultations on two of the three forthcoming programs slated to commence this year. Legislation for all these initiatives is expected to be introduced by the end of next year, as per the source, who spoke on condition of anonymity.

Further allocations for ITCs directed towards machinery and tools needed for green technology construction, as well as for hydrogen production, are likely to be presented in spring 2024. Clean electricity ITCs are slated for release in the fall, as per the source.

In addition to the aforementioned measures, the Fall Economic Statement is reported to allocate C$15 billion in 10-year loans for new rental housing construction, earmark a C$1-billion fund dedicated to fostering affordable housing, and introduce new mortgage regulations for lenders handling at-risk homeowners, as cited by the Canadian Broadcasting Corp referencing an unnamed source.