Why More Buyers in Canada Want Green Homes

In Canada’s overheated housing market, buyers are making sharper decisions than ever before. Every dollar is weighed, every square foot scrutinized and every long-term cost considered. Against that backdrop, the demand for green homes has been climbing steadily.

What once seemed like a niche interest has become a mainstream priority. Rising energy costs, climate awareness and affordability concerns have shifted the conversation. More buyers are asking not just, “Can I afford this house?” but, “Will this house save me money over time?”

The answer increasingly lies in the green features built into the home itself.

The Economics of Green Homes in 2026

The Canadian housing market has long been defined by imbalance: high demand, tight supply and escalating prices in major cities. By the end of 2025, the average home price across Canada hovers above $700,000, with Vancouver and Toronto pushing far beyond that. For many families, affordability has already reached breaking point.

In this environment, green homes stand out not simply as ethical choices, but as economic ones. Energy inflation has redefined the cost of ownership. Utility bills, once a secondary concern, now rival mortgage payments as household budget lines. A home that can reduce energy consumption by 30 to 50 percent is not just a lifestyle upgrade. It is a hedge against volatility.

Get the Green Building Project Checklist

Use this handy checklist on your next project to keep track of all the ways you can make your home more energy-efficient and sustainable.

Why Energy Inflation Changes the Calculation

The cost of energy has surged in recent years. Electricity, heating and cooling all carry higher price tags, driven by global supply issues and domestic demand. Homeowners feel this strain month after month.

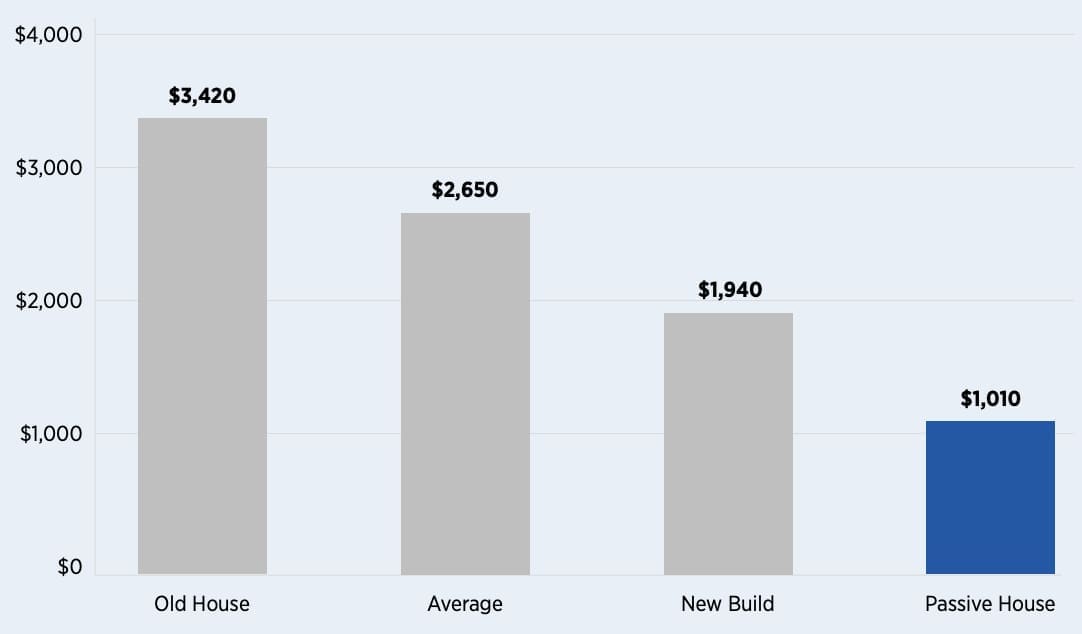

Annual Home Energy Costs in Canada (By House Type)

Costs include heating and cooling, water heating, appliances, equipment and lighting (excluding transportation energy costs) for a 1,500 square-foot house. “Old House” are built before 1946; “New Build” are built after 2019.

Source: Powering Canada: A blueprint for success, CEAC

A well-insulated, airtight home with efficient windows and HVAC systems reduces reliance on external energy, making a sizeable impact on home energy costs. According to research from the Canada Electricity Advisory Council, a Passive House uses 62 percent less energy than the average house in Canada, amounting to a savings of $1,640 annually. Over 20 years that’s $32,800 in the bank. Add renewable options like solar panels and households can generate part of their own supply to drive costs even lower.

For buyers staring at decades of ownership, that long-term stability is compelling. Green upgrades are no longer viewed as nice-to-have add-ons. They are risk management tools.

Green Homes as a Hedge Against Inflation

Financially, green homes offer what economists call “inflation resilience.” When external costs rise, efficient homes absorb less of the shock.

- Solar energy cuts exposure to electricity price hikes.

- Energy-efficient windows reduce heating and cooling costs by maintaining indoor temperatures.

- Heat pumps use less power for the same output, lowering monthly bills.

- Tight building envelopes ensure energy is not wasted, maximizing every kilowatt.

The upfront premium on these features may raise the purchase price. But when amortized over decades, the value compounds. For many buyers, the long-term financial case outweighs the short-term sticker shock.

From Lifestyle Choice to Mainstream Expectation

Ten years ago, green homes were seen as a lifestyle choice. Buyers willing to pay more for eco-friendly features were in the minority. Today, that psychology has flipped.

Surveys conducted across Canadian markets show buyers increasingly expect energy efficiency as a baseline. Based on the 2025 CMHC Mortgage Consumer Survey, 61 percent of homebuyers consider energy-efficient features to be an important factor in their decision. Just as granite countertops became a standard feature in the early 2000s, efficient insulation, Energy Star appliances and smart thermostats are becoming minimum requirements.

For sellers, this shift means that homes lacking sustainable features may face steeper discounts. Buyers are factoring long-term operating costs into their offers, and the math is unavoidable.

Suburb vs. City: The Value Gap

Green homes are not only changing the types of properties buyers want, but also where they are looking.

Major cities like Toronto and Vancouver have become prohibitively expensive. Buyers seeking affordability without sacrificing quality are turning to surrounding suburbs. Oshawa, Milton and Brampton, for example, have emerged as strong alternatives to Toronto, offering more space and relative affordability. For buyers balancing sustainability and cost, the suburbs are fertile ground.

The same pattern exists across Canada. Surrey and Langley, for example, are more accessible options than Vancouver while suburbs outside Calgary and Ottawa are also drawing buyers priced out of city cores. In each case, buyers are evaluating not just the purchase price, but the long-term financial stability offered by greener housing stock.

Numbers That Matter

To make the case clear, let’s break down the numbers.

A traditional 2,000-square-foot home might cost $250–$350 per month in combined energy bills whereas a green-certified equivalent with proper insulation, energy-efficient HVAC and solar can cut that to $100 or less.

Over a decade, that’s a difference of $24,000. Over a 25-year mortgage horizon, the difference approaches $60,000.

When layered against rising energy inflation, the case becomes even stronger. If rates increase by 5 to 10 percent annually, the gap between efficient and inefficient homes only widens.

The Role of Green Certifications

Certification programs such as LEED, Energy Star and Built Green provide measurable standards for energy efficiency and sustainability. These labels offer more than bragging rights. Though they do translate to additional costs for a house, they create transparency for buyers who want to quantify the value of what they are paying for.

Certified homes often command higher resale prices. Appraisers are beginning to factor sustainability into property valuations. For buyers worried about long-term liquidity, this added resale value is another layer of financial security.

Builders, Developers and the Market Response

Developers are not blind to these shifts. Across Canada, new construction increasingly incorporates sustainable design. Building codes in provinces such as British Columbia and Ontario already encourage higher efficiency.

The business case is simple. Buyers are demanding it. Builders who ignore sustainability risk losing competitiveness. Those who embrace it position themselves to capture the growing segment of environmentally and financially conscious homeowners.

Health and Comfort

While financial savings drive many decisions, buyers also recognize non-monetary benefits. Green homes often provide superior indoor air quality, more consistent indoor temperatures, and quieter living environments.

These features translate into higher satisfaction and well-being. For families planning decades in one home, those qualitative benefits carry weight alongside the dollar savings.

Financing Green Homes

Affordability remains the central challenge. Even with long-term savings, the upfront cost of green upgrades is higher. Lenders are beginning to respond with financing products tailored to sustainability. Some banks offer green mortgage discounts, rewarding borrowers who purchase or upgrade to efficient homes.

Government rebates and incentive programs further offset costs. From green home loans to retrofit grants, buyers who explore their options can significantly reduce the initial outlay.

Check out the following resources to find incentives that are right for you:

- Green Building Incentive Finder

- Solar Incentive Finder

- 9 Green Loans and Mortgages You Can Use to Finance Your Green Building Project

The Outlook for 2026 and Beyond

As we move into 2026, the demand for green homes in Canada will not taper. Energy inflation shows no sign of reversal. Climate awareness is mainstream. And affordability pressures mean buyers are searching for ways to stabilize household costs.

The result is a structural shift in the housing market. Green homes are no longer niche. They are moving towards becoming the baseline expectation. Sellers who embrace this trend will preserve value. Buyers who prioritize it will protect themselves against volatility.

Green Homes as a Smart Investment

The Canadian housing market has always been challenging. But within that challenge lies opportunity. Green homes offer not just sustainability, but resilience.

For buyers, the question is not whether you can afford to pay a little more upfront. The question is whether you can afford not to. In a world where energy costs climb and affordability erodes, homes that deliver stability and savings are more than lifestyle choices. They are financial strategies.

For families searching outside the overheated city cores, the suburbs present the best balance. Whether you’re considering a house in Surrey over Vancouver or whether you’re looking to buy a house in Oshawa instead of Toronto, the opportunity lies in finding homes that combine affordability with sustainability.

Green homes are not just the future of housing. They are the hedge households need as we move into the future.

Images from Depositphotos